Thailand’s Eastern Seaboard has long been a manufacturing hub with numerous international firms operating in the region. In an attempt to stimulate further growth and broaden the area’s appeal, the Thai government branded this strategically located destination as the Eastern Economic Corridor and announced two major policies designed to transform the area.

When the inaugural Pattaya Arts Festival was held in early February along the city’s famed Beach Road, it offered a glimpse of what the present looks like and what the future may hold. Tourists and locals mingled with international artists and browsed booths stocked with goods from creative Thai companies. On the other side of Beach Road remained the beer bars and sellers peddling cheap products that Pattaya has developed a reputation for.

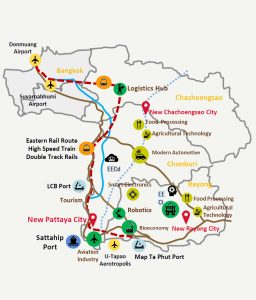

The contrast was stark and could be a sign of things to come for the Eastern Seaboard. The government approved the Eastern Economic Corridor (EEC) development project in 2017 and is heavily promoting its Thailand 4.0 policy at the moment. The EEC project is designed to draw in foreign investment and improve the region’s infrastructure while Thailand 4.0 is a government initiative focusing on education and other projects designed to create a value-add economy. The end goal is to no longer be solely reliant on low-value manufacturing investment.

“At the moment, Thailand is at the bottom of value chain activity. The country mostly draws in original equipment manufacturers (OEMs) from abroad at this time because labour is cheap here,” Dr Pavida Pananond, Associate Professor of International Business at Thammasat Business School, states. “While what this brings is important to the country’s economy, it also means there is a ceiling and Thailand has hit that ceiling.”

The EEC provinces of Chon Buri, Rayong, and Chachoengsao currently account for nearly 20 percent of the country’s total GDP, according to government statistics, but there is a belief the major industrial area may have reached its peak unless something changes.

“Thailand can’t solely rely on OEMs because it is only so valuable to both the country and the international companies investing and operating here,” Dr Pavida explains. “Don’t get rid of manufacturing, but instead find ways to add value to it and make sure you’re providing foreign companies with value in other places, whether it be technology, skilled labour, research and development or through online platforms.”

Thailand Prime Minister Prayut Chan-o-cha is spearheading the Thailand 4.0 policy going as far as to speak at seminars attended by foreign investors to explain the government’s hopes for the project. Despite this initial commitment, experts note the plan will require decades of proactive support from the Thai government.

“These plans will require the Thai government to look at the long term picture instead of being reactive,” Dr Pavida says. “The government should see what it will take for these plans to be successful and then commit to getting it done. While there has been a lot a talk about Thailand 4.0, it will be important to see how committed the government is when it comes to implementing it.”

Tax breaks & better transport

The fruits of the EEC development project won’t take nearly as long to bear, as the government wants to reduce logistical costs for companies based in the EEC and make it more attractive to do business here. The region is vital to global supply chains since it can offer access to China and India as well as Southeast Asia. However, it lacked an international airport, rail links and port capacity prior to the plan’s approval.

Some of the EEC’s infrastructure improvements are already under construction and scheduled to be completed this year. One project, the U-Tapao International Airport, opened the renovated international terminal in 2016 and the number of passengers and flights using the facility is expected to increase this year. Construction continues on the airport, which could handle up to three million passengers annually once completed.

Plans also call for construction of a deep-sea port at Map Ta Phut and modernisation of the port at Laem Chabang. Once completed, the EEC will link the Dawei deep-sea port in Myanmar to the Sihanoukville port in Cambodia and Vung Tau port in Vietnam.

In addition to the infrastructure projects that will eventually improve land, sea, rail and air links, the government is hoping to attract international firms to the EEC by expanding current tax incentives. For example, businesses willing to set up a research and development facility in the EEC will receive a corporate income tax exemption for up to 15 years. EEC development plans also allow foreign companies to buy land for factory sites, something not permissible in the past.

During the unveiling of the EEC development plan in June 2016, Kanit Sangsuphan, Head of the Finance Ministry’s working group to enhance private investment, said the government expected THB 1.5 trillion in private investment to come into the Eastern Economic Corridor between 2016 and 2021.

Finding the benefits

Jotun, a Norwegian paint manufacture, has been operating in Thailand for nearly 50 years and currently bases some of its Asia-Pacific operations in Chonburi. The company believes both the EEC Development plan and Thailand 4.0 will be beneficial in the short and long term.

“The government has not been in touch with us in regards to the EEC or Thailand 4.0, but we have been invited to a number of conferences and events on both topics explaining their benefits,” Andreas Stolt-Nielsen, General Manager Decorative at Jotun Thailand Limited, says. “However, we having been operating in Thailand for such a long time and view ourselves as more of a local company, The government wants to attract new businesses to the country with these policies.”

The company expects the new infrastructure projects will be a boon to the region and will successfully bring in new foreign investment. That, in turn, will benefit its various paint divisions.

“All segments of Jotun will likely benefit from the policies. New factories and facilities will be built which our segments like protective, decorative and powder will cover,” Stolt-Nielsen explains. “The infrastructure projects will bring in more ships when ports are ready which also will benefit our marine coatings division. From our perspective, there are a lot of positives the EEC projects will bring.”

It’s not just Jotun likely to benefit from the new policies. Both Thailand 4.0 and the EEC development plan could create new opportunities for Norwegian firms, especially those looking to increase their footprint in Thailand and the Asia Pacific region. Companies from Norway are already very active in the fishing industry and “The Land of Smiles” could soon tempt others.

“Companies from Norway may see these new policies being implemented by the government and revisit the idea of investment or expansion opportunities in Thailand,” Stolt-Nielsen said. “Those considering it now should act early to take full advantage of the opportunity.”

Will it work?

And while Jotun is optimistic the infrastructure projects will be completed as promised, the company isn’t sure when everything will be completed due to the size and scope of the ECC development plan.

“We are waiting to see more from the government in regards to planning and managing these infrastructure projects moving forward,” Stolt-Nielsen said. “I’m sure they will all be completed, but the Eastern Economic Corridor timetable is still unclear.”

Mr Stolt-Nielsen is not alone in this uncertainty. Many firms and analysts are cautiously optimistic as to what the results of the EEC development plan and Thailand 4.0 will bring. According to Dr Pavida, the government will play a large role in the success or failure of both and, despite generous tax incentives and potential opportunities, many firms will opt to wait on the sidelines until more progress is made.

Planning for change is easy, but as those who visited the Pattaya Arts Festival saw, it can look a bit awkward when lined up across from the past. Much like how Pattaya is still dependent upon visitors who seek out its nightlife and entertainment venues despite attempts to broaden the city’s appeal, the economy of the Eastern Seaboard will remain tied to OEMs. The EEC Development plan and Thailand 4.0 aren’t likely to change this entirely, but Dr Pavida notes the new policies should retain and attract forward thinking businesses.