Financing is undoubtedly the most important aspect of real estate. If people can’t buy houses, nothing can happen. However, technology has been unable to improve this process in Asia. Indonesia proptech startup IDEAL has started to change that by connecting people with mortgages through its online aggregator and application submission platform.

Millennials and Gen Z are constantly frustrated by the slow and cumbersome process of finding a mortgage. This is especially true in Indonesia with its young population of digital-savvy consumers. Going from bank to bank in search of the best possible mortgage is something this group has no interest in.

That is where Indonesia proptech startup IDEAL enters. It wanted to simplify the complex research and application process required to find a mortgage. The firm created an aggregator and submission platform that assists prospective homeowners in their journey by maximizing their purchasing power and optimizing available financial choices.

There is, of course, another side to the transaction process–developers and banks. They are also connected to IDEAL’s platform. This allows them to expand their network of potential customers and buyers without diverting massive resources into marketing.

IDEAL currently has agreements with five national banks as well as countless leading property developers in Indonesia. The proptech startup continues to search for new partners as it looks to expand from a Jakarta-focused network to a countrywide one.

Also Interesting: Durianpay has become the go-to payment solutions provider in Indonesia

AC Ventures and Alpha JWC Ventures close pre-seed funding

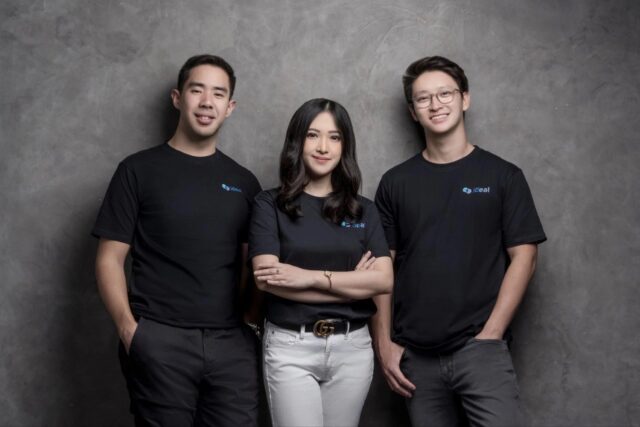

In 2022, IDEAL raised US$3.8 million in pre-seed funding with AC Ventures and Alpha JWC Ventures leading these efforts. This was seen as the next step for a company led by Grab-backed e-wallet player Ovo veterans Albert Surjaudaja and Indira Nur Shadrina.

Keep Reading: Indonesia blue-collar job platform lands backing from Y-Combinator and Alpha JWC